Gross Income Calculator Uk

Hourly rates weekly pay and bonuses are also catered for. The latest budget information from April 2021 is used to show you exactly what you need to know.

If you enter 5 a month enter 5 if you pay 100 please enter 100.

Gross income calculator uk. If your salary is 45000 a year youll take home 2853 every month. Also known as Gross Income. If you have a salary sacrifice please enter the amount after sacrifice unless the sacrifice is for childcare vouchers or pension and they have been detailed in the calculator.

Your gross hourly rate will be 2163 if youre working 40 hours per week. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240.

The simple UK income tax calculator. The gross to net salary calculator below outlines the salary after tax for every level of gross salary in the UK. Figure out Gross ProfitResale - Cost Gross Profit12 resale - 7 cost 5 Gross ProfitStep 2.

Income tax calculator. Funded pension II pillar. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

We offer you the chance to provide a gross or net salary for your calculations. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. Two Simple StepsStep 1.

Why not find your dream salary too. You will see the costs to you as an employer including tax NI and pension contributions. You can use the net salary after tax figures to work out how much your take-home salary is after all.

Wage is normally used to describe your monthly gross income. Calculate your take-home pay given income tax rates national insurance tax-free personal. Divide Gross Profit by Resaleand multiply times 100 to get the percentageGross Profit Resale 100Example5 Gross Profit 12 Resale 4166Then multiply by 100 to get the So 4166 x 100 4166So your gross.

21 rader Gross to Net Salary Calculator 202122. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Use the calculator to work out an approximate gross wage from what your employee wants to take home.

Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. 1 Select tax year.

This will in turn reduce the amount of tax national insurance and. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear.

GROSS INCOME - Enter the gross income you receive from your employment. Summary report for total hours and total pay. No nonsense UK income tax salary calculator - updated for the 201920 tax year.

Use the calculator to work out what your employee will take home from a gross wage agreement. 201819 201920 202021 202122 202223. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own.

Please see the table below for a more detailed break-down. An easy to use yet advanced salary calculator at your fingertips. Find out the benefit of that overtime.

See your income tax pension childcare student loan and national insurance breakdown. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere.

Your net wage is found by deducting all the necessary taxes from the gross salary. Salary Sacrifice - Your employer will reduce your Gross Salary by the Pension amount. Youll then get a breakdown of your total tax liability and take-home pay.

We strongly recommend you agree to a gross salary. Total Cost for Employer Wage Fund. Our salary calculator will provide you with an illustration of the costs associated with each employee.

Pension Types - Select the type of Pension you have. Find out your take-home pay - MSE. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more.

Simply enter your annual or monthly income into the salary calculator above to find out how UK taxes affect your income. Salary Before Tax your total earnings before any taxes have been deducted.

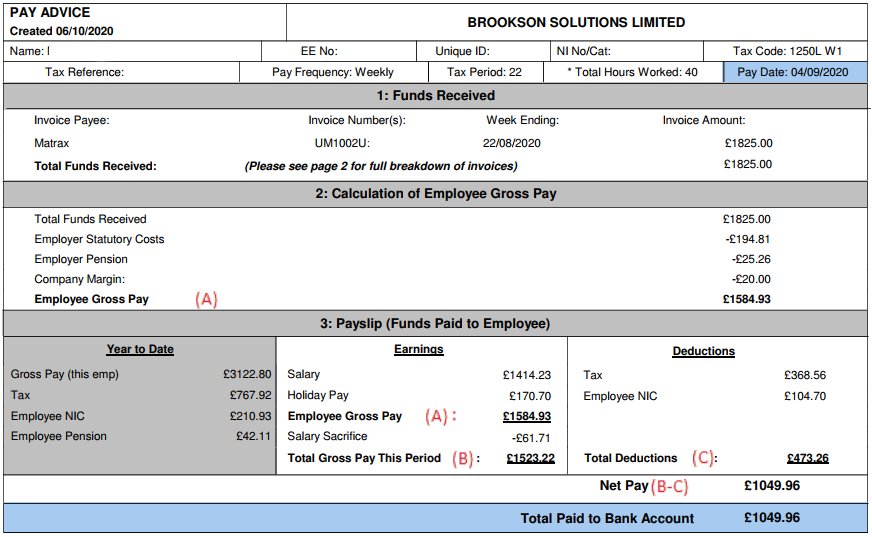

Your Umbrella Payslip Explained Brookson Faq

Income Tax Co Uk Uk Tax Calculator Home Facebook

Comparison Of Uk And Usa Take Home The Salary Calculator

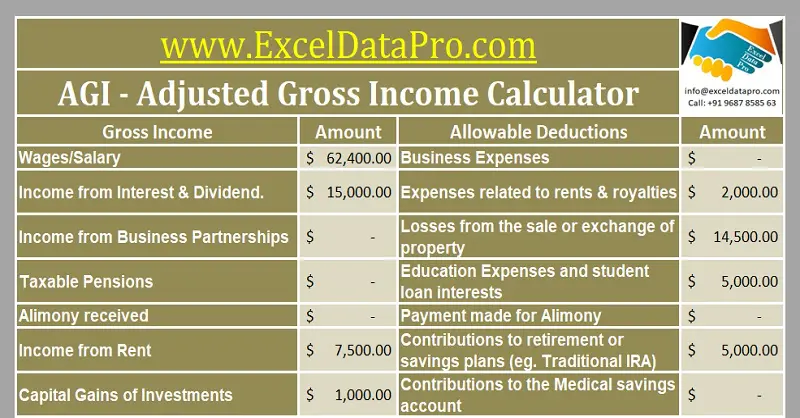

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

45 000 After Tax 2021 Income Tax Uk

Annual Income Learn How To Calculate Total Annual Income

Taxable Income Formula Calculator Examples With Excel Template

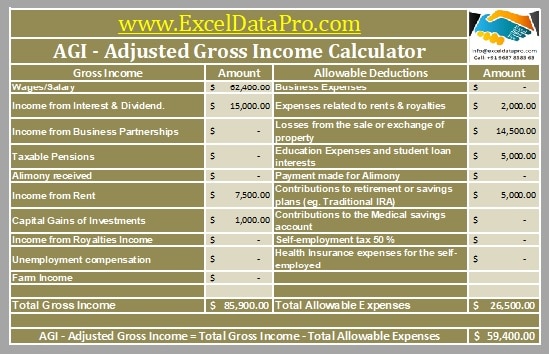

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Comparison Of Uk And Usa Take Home The Salary Calculator

1 560 A Month After Tax Uk July 2021 Incomeaftertax Com

Nanny Salary Pension Calculator Gross To Net Nannytax

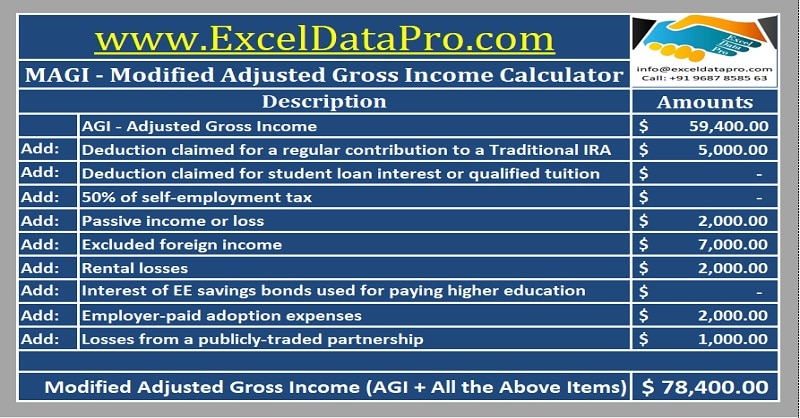

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Ask Sage Income Tax Paye General Information And Manual Calculations

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

3 Ways To Work Out Gross Pay Wikihow

Ask Sage Income Tax Paye General Information And Manual Calculations

Comments

Post a Comment